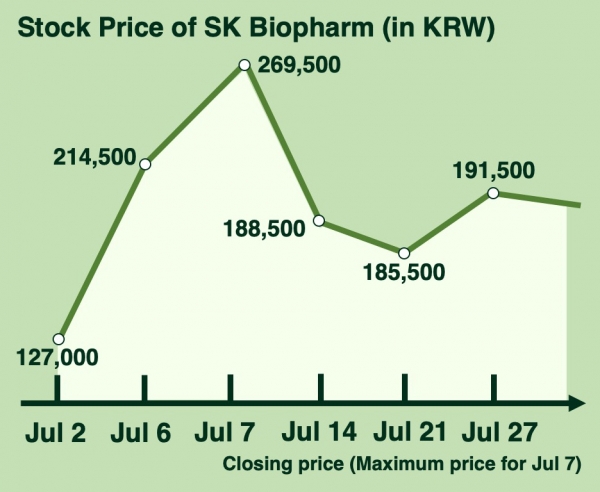

The stock price of SK Biopharmaceuticals (SK Biopharm) is sharply rising. After being listed on the Korea Composite Stock Price Index (KOSPI) on July 2, SK Biopharm’s stock price jumped more than 5-fold, from 49,000 KRW (July 2) to 269,500 KRW (July 7), in only five days. The stock price has maintained a high price as it evaluated 187,000 KRW on July 29. Even though SK Biopharm is expected to be celebrating such stock price increase, this victory is not good news for them. In fact, quite a lot of employees are considering quitting.

SK Biopharm was founded in 2011, splitting from SK. Despite its short history, it is now regarded as a top Korean pharmaceutical company along with Celltrion and Samsung Biologics. The key element of its rapid growth is its Research and Development (R&D) strategy. Celltrion and Samsung Biologics so far focused on developing biosimilars—a mimicry of a previously approved biological medicine. It has not been long since they started developing new medicines. In contrast, SK Biopharm targeted the development of new medicines only. A patent duration is given to a new medicine to protect it from being copied by biosimilars. Hence, new medicines potentially bring more success to the company than biosimilars. This is why SK Biopharm was the right place for investment.

Then why are some employees considering resignation? Initially, 11,820 stocks on average were given as a stock option to all 207 employees. During the first year of being listed on KOSPI, selling stocks owned by employees is banned. However, if an employee resigns, he or she is able to sell the stocks and gain profit. In this case, the profit one gains equals the product of the change in stock price, which is 191,500 KRW minus 49,000 KRW, and the number of stocks per employee, which is 11,820. Hence, quitting can be a way of gaining about 1.6 billion KRW on average. Furthermore, as employees quit, the workload for remaining employees increases, encouraging more to quit. For such reasons, more than 10 employees have left SK Biopharm.

However, not everyone is leaving. Employees must work at least one month from the date of their request for resignation, and the stock sale is done the following month. They do not know whether the stock price will stay high then. If the stock price decreases, they will have lost their jobs without gaining any profit. Also, as it is currently a hard time to find a job due to COVID-19, it takes huge courage to resign.

This stock option was an inevitable choice for SK Biopharm. Due to the current Capital Market Law, all companies listed on KOSPI must distribute at least 20% of their stock to their employees. For small-sized companies, such as SK Biopharm with 207 employees, the amount of stock one employee must hold becomes large.

A stock option was originally intended to gather workers without cash and make employees enthusiastic about contributing to the advancement of a company. However, for SK Biopharm, stock options contrarily became a driving force of quitting. The stock option dilemma of the company shows the possibility of stock options being degraded into just a tool for earning money.

Nevertheless, SK Biopharm is looking ahead to a bright future. XCOPRI® for adult epilepsy was released in the U.S., and its approval is in progress in Europe. SUNOSI® for sleep disorder was licensed out by the U.S. Food and Drug Administration and the European Medicines Agency after completing phase one clinical trials. If SK Biopharm successfully overcomes this stock option dilemma, it is expected to lead the Korean pharmaceutical industry, developing new medicines instead of biosimilars.