Revisions to the Korea Electric Power Corporation Act (KEPCO Act) have been submitted to the National Assembly of the Republic of Korea to raise the limit on the issuance of KEPCO’s company. It is expected to suffer a record deficit of more than 30 trillion KRW this year. In response, the Trade, Industry, Energy, SMEs, and Startups Committee is discussing ways to increase KEPCO’s issuance limit of corporate bonds from two times, to five times, eight times, and 10 times of capital and reserves. An upward revision seems inevitable to prevent a default next year, but concerns are being raised as it is not only a temporary measure to prevent debt but also a tightening of the money market.

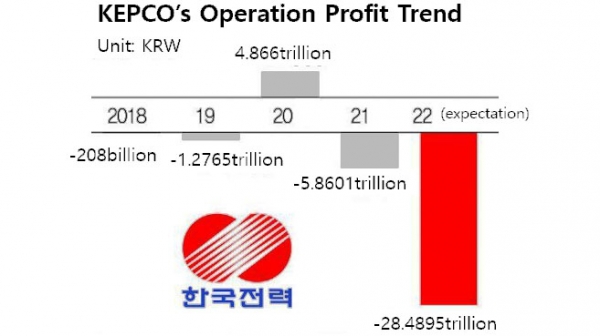

According to KEPCO on Nov. 22, the operating loss of the settlement of accounts rose 1,842.5% from 1.124 trillion KRW last year to 21.834.2 trillion KRW in the third quarter of this year, falling into a deficit quagmire for the sixth consecutive quarter.

The problem is that under the current KEPCO Act, the limit on corporate bond issuance cannot exceed twice the amount added to capital and reserves. With the limit tied under the current KEPCO Act, KEPCO could be on the verge of default if the company's issuance limit falls below 30 trillion KRW next year. The payment of trillions of electricity transactions may also be disrupted, which could lead to problems in the electricity markets. If the deficit continues until the next year, there is a dark outlook that all capital and reserves will be exhausted by 2024.

However, it is not easy to make decisions in conjunction with the current money market situation. Recently, the 205 billion KRW project financing (PF) Asset Backed Commercial Paper (ABCP), which was guaranteed to create Legoland, went bankrupt in October this year, causing confusion in the financial markets, including a bond market crunch. Among them, as funds flocked to KEPCO, the highest credit rating (AAA), there are concerns that raising the limit on corporate bond issuance could accelerate the fund market crisis. Lee Chang-yang, the minister of the Ministry of Trade, Industry and Energy (MOTIE) stressed, “It is not easy for the situation to improve soon for the time being. The biggest task is to change the factors of the rise gradually and continuously in costs to the extent that they do not shock the economy.”